Credit scoring service in Qatar Credit Bureau is a system that assesses an individual's creditworthiness based on various factors such as their credit history, outstanding debts, payment patterns, and the overall financial behavior. It helps financial institutions and lenders in Qatar to evaluate the risk associated with extending credit to individuals. By using this service, lenders can make more informed decisions when considering loan applications, credit card approvals, or other financial services. The credit scoring service ultimately aims to promote responsible borrowing and lending practices while ensuring a fair and transparent system for all parties involved.

Product Overview

Credit Scoring Mark issued by Qatar Credit Bureau is an indicator to the possibility of a customer's default over a period of time.

The Credit Scoring Mark is ranged from 300-850, where the largest number indicates a lower risk level.

The following table illustrates the credit scoring marks:

Factors influencing credit scoring

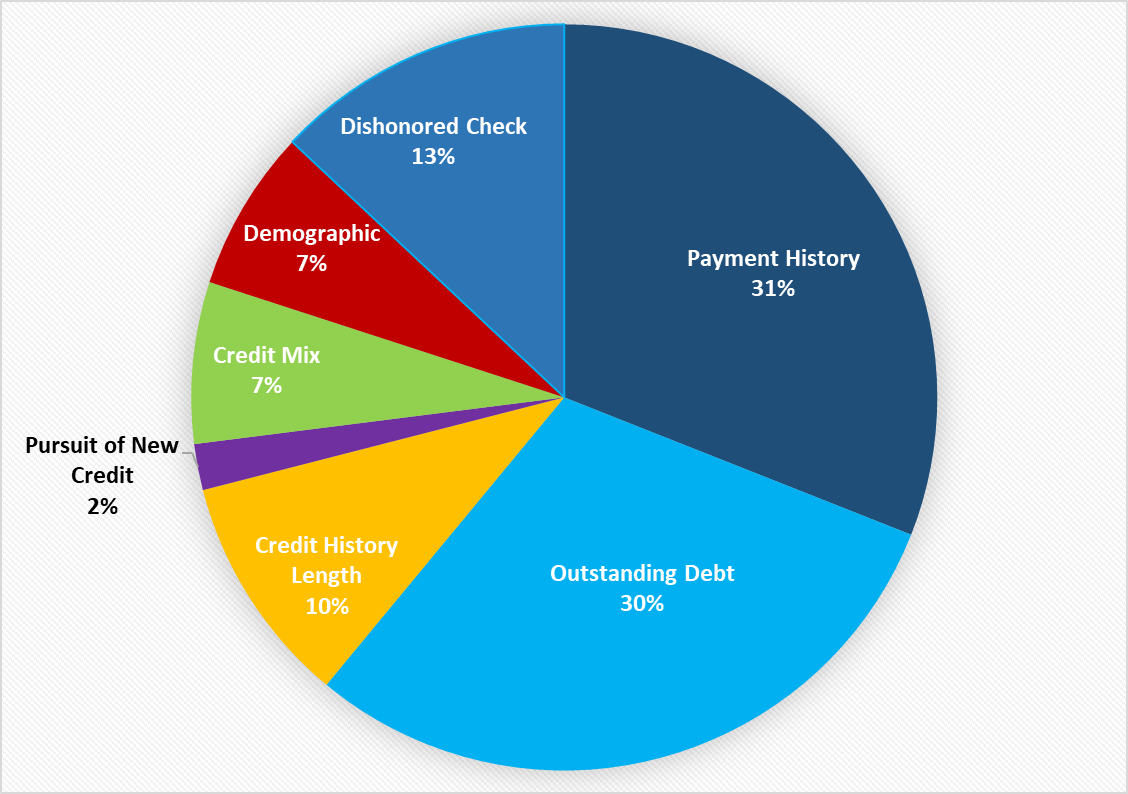

The following pie chart shows the factors influencing credit scoring of individuals and the percentage of each factor:

Explanation of Credit Scoring factors:

1- Payment history (31% of your score)

This means whether you've paid your past credit facilities on time.

2- Outstanding Debt (30% of your score)

The amount of outstanding balance and credit limit available for use.

3- Length of credit history (10% of your score)

The duration you've had these credit facilities accounts.

4- Credit mix (7% of your scores)

This factor demonstrates your commitment towards your financial responsibilities by making payments to a variety of your credit facilities (installment loans, overdraft, credit cards) on the specified dates.

5- New credit (2% of your score)

This factor refers to the frequency of your credit report inquires for the purpose of granting new credit facility. Also, it refers to the number of recently opened credit facilities.

6- Demographic (7% of your score)

Your age compared to that of other individuals who were scored.

7- Dishonored Cheques(13% of your score)

Number of dishonored cheques due to insufficient balance and how recent these checks are.